Wealth Preservation

Through Capital Gains Tax Deferral and Innovative Investment Strategies

The Deferred Sales Trust™ is not new nor is it an untested structure. The same structure was written about in 1986 by the Harvard Law Review stating, “This is an example of the time value of money principle because the seller during the period of deferral can invest the money that otherwise would be used to pay the taxes. They are in effect receiving an interest-free loan from the government.”

Harvard Law Review Vol. 100, No. 2 (Dec. 1986), pp. 403-422 Published by: The Harvard Law Review Association.

What is a Deferred Sales Trust™?

Think of a Deferred Sales Trust™ (DST) as an IRA for real estate and business sales with additional flexibility.

With an IRA, you defer paying taxes on earned income for as long as the income is invested rather than received. This system allows the earnings from the investments to pay the taxes over time rather than paying taxes in the year of the earnings.

Similar to an IRA, with a Deferred Sales Trust™ you also defer paying taxes on the profit of a real estate or business sale as long as the profits are invested by the DST rather than the seller taking constructive receipt of the funds at the time of the sale. This system allows the earnings from the investments to pay the taxes over time rather than in the year of the sale.

The DST structure does not have restrictive limits on the deferral period, and you can withdraw funds as needed and only pay taxes on the amount withdrawn. If set up properly, funds may be reinvested back into real estate without the time constraints of a 1031 exchange.

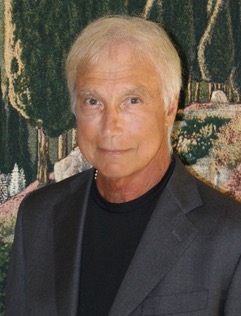

Meet

Jim Worley

Having over 35-years’ experience in real estate development, planning, marketing; brokerage, finance and consultation, Jim Worley has often witnessed the results of poor tax planning when selling a highly appreciated property or business. Jim is a tax deferral strategist and a real estate referral specialist. Jim specializes in educating seasoned real estate investors, wanting to cash out of real estate portfolios without having to pay in California, 37.1% of their net gain in the year of the sale. Through negotiated arrangements with the company that holds the exclusive trademark rights to the Deferred Sales Trust™ (DST), Jim is offering this program to the general public. This website is your introduction to this tax code compliant tax deferral program that has been used and tested for well over twenty years.

Prior to joining DST Wealth Management, Jim was a consultant for The Alta Verde Group, of Beverly Hills, California in the capacity of development coordinator. Assisted by his direction, The Alta Verde Group assembled projects in Palm Springs and La Quinta, California. Those projects represented 260-permit ready single-family residential lots with potential sales in excess of $155,000,000.

Mr. Worley has consulted in both Capital and Real Estate markets and successfully originated and closed over a quarter billion dollar in residential and commercial loans. Jim has provided transaction and finance advisory services to and with clients involved in corporate, construction and real estate issues. Project assistance for clients include: Arranging for project acquisition and finance; Owner’s relationship representative for clients and lender liaison; Staff interviews and selection; Property and community demographic reviews; Government and building authority representation. Mr. Worley is a licensed Real Estate Broker in the State of Texas and a licensed agent in California. Currently Jim is the project organizer and advisor in the development of two senior care assisted living developments, one in San Diego and the other in Santa Barbara, Ca.

Jim resides in Coronado, Ca., has two daughters, three grandchildren, is a member of The National Association of Eagle Scouts, the Navy League and served honorably for four years in the U. S. Navy. Jim is an avid runner, hiker and outdoorsman.